The Central Public Schools Community has a history of being strong supporters of their school district and we thank you for your dedication to our students.

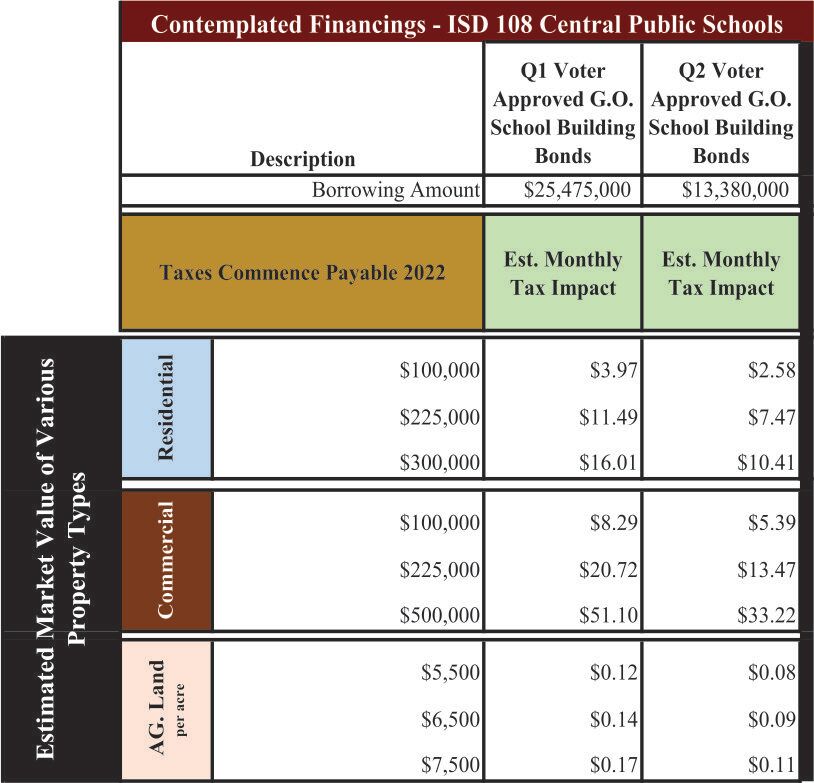

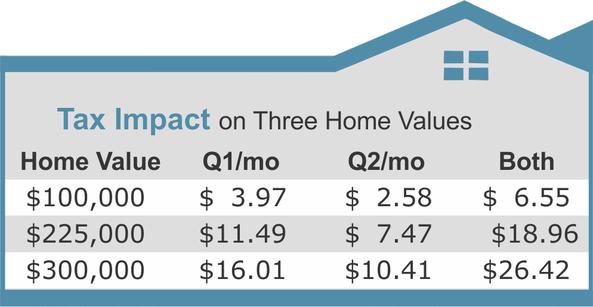

If Question 1 is approved, the average home value of $225,000 would see a monthly tax increase of $11.49.

If Question 2 is approved, the average home value of $225,000 would see an additional monthly tax increase of $7.47.

If both questions are approved, the average home value of $225,000 would see a total tax increase of $18.96 a month.

Use the online tax calculator to calculate the impact on your property.

If Question 1 is approved, the average home value of $225,000 would see a monthly tax increase of $11.49.

If Question 2 is approved, the average home value of $225,000 would see an additional monthly tax increase of $7.47.

If both questions are approved, the average home value of $225,000 would see a total tax increase of $18.96 a month.

Use the online tax calculator to calculate the impact on your property.

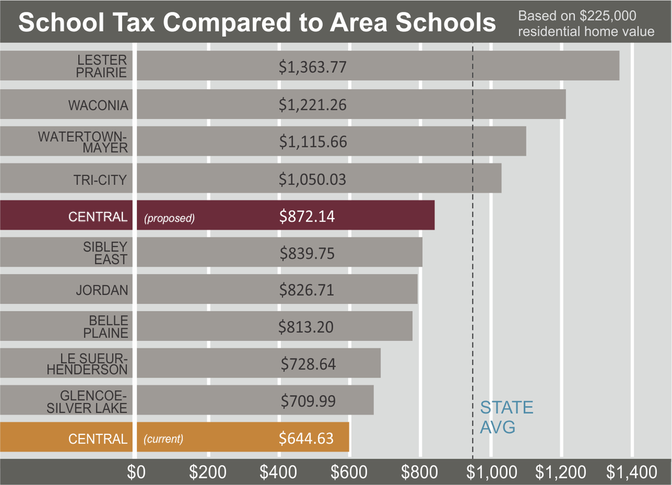

How does Central compare to our neighbors?

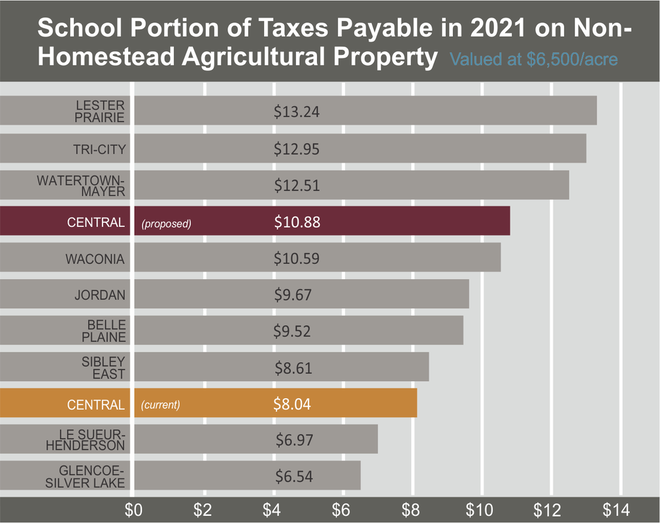

Our local school taxes are low compared to our neighboring districts. For residential properties, we have the lowest school taxes of all of our neighbors. If both referendum questions are approved, we would move to the middle of the pack. The tax impact for agricultural properties in the district would be in the middle of our neighbors.

Is there relief for Agricultural Properties? |

Who pays for the referendum? |